August 2023 Market Update

The July stats are in, and Calgary set another monthly sales record. This happened with July inventory levels, the lowest since 2006.

Feel free to keep reading, or you can watch my market update video here instead:

So, what is causing both high demand and low inventory? How long might these conditions last? And how does this impact those who plan to move over the next 12 months?

Let’s start by looking at those July record sales numbers closely.

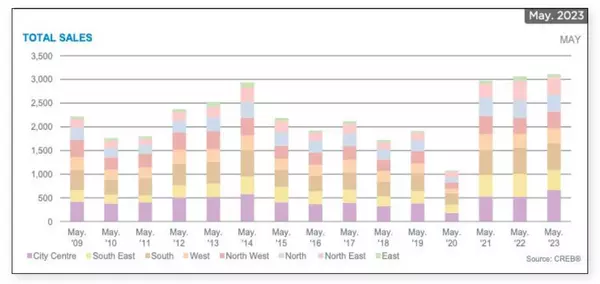

Here is the Total Sales graph from the Calgary Real Estate Board. This is the first time that a July has crested the 2500 sales mark, and as you can see, it is quite a bit stronger than any of the previous Julys going back to 2009.

July isn’t the only month to break a sales record this year. This is the 3rd consecutive time it happened after May and June set their own monthly records.

So where is all this demand coming from?

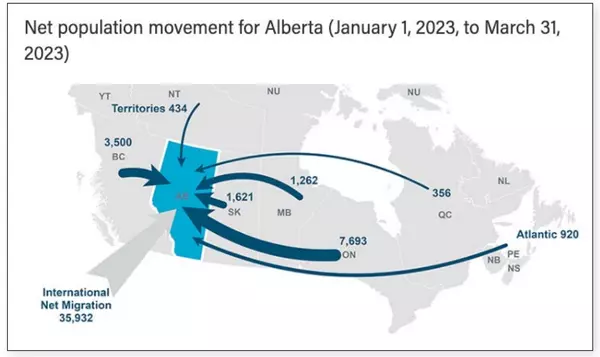

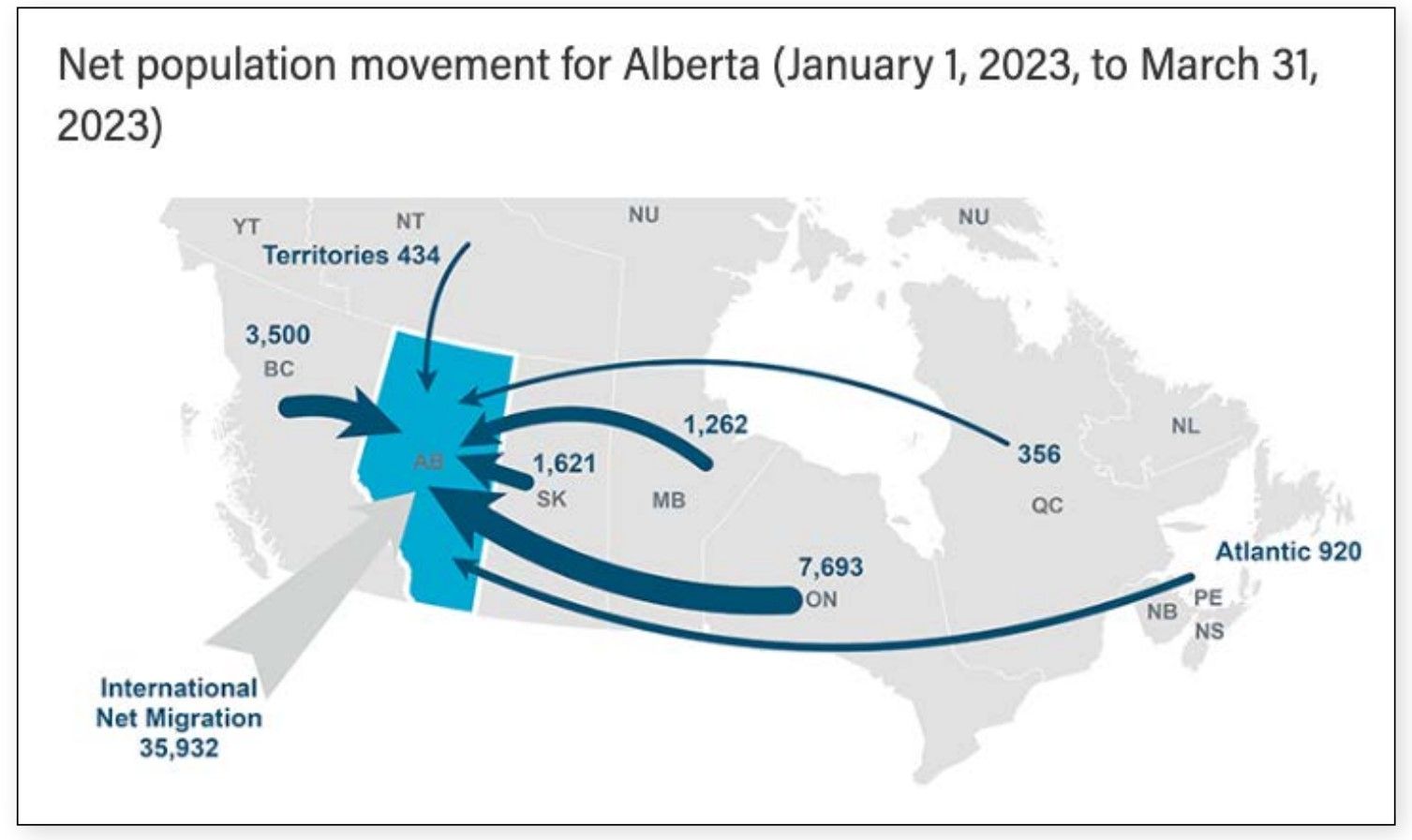

Let’s bring back this graph from earlier this year, which shows the Migration numbers into Alberta. In Q1 of 2023, net migration into the province was just over 51,000 people compared to just over 16,000 in Q1 of 2022, an increase of 207.5%.

This sort of influx of people takes time to settle. Some of these people enter the housing market right away, while some will enter the rental pool initially, intending to transition to ownership eventually.

I have overheard a few people talk about waiting to move until the market either levels out or turns. And while we can never say anything for sure, right now, Alberta’s demand is expected to continue and is not forecasted to change in the foreseeable future.

Alberta’s former Minister of Finance Travis Towes, said it best:

Alberta’s Allure is not hard to see. Our lower cost of living, affordable housing, abundant jobs, higher earnings and lower taxes attract newcomers from all over the country and abroad.

So, as long as Alberta continues to stand out this way, people will continue moving to the province.

So we have talked about the demand coming into the city helping to drive those record sales numbers. Let's look at the supply levels these people choose from.

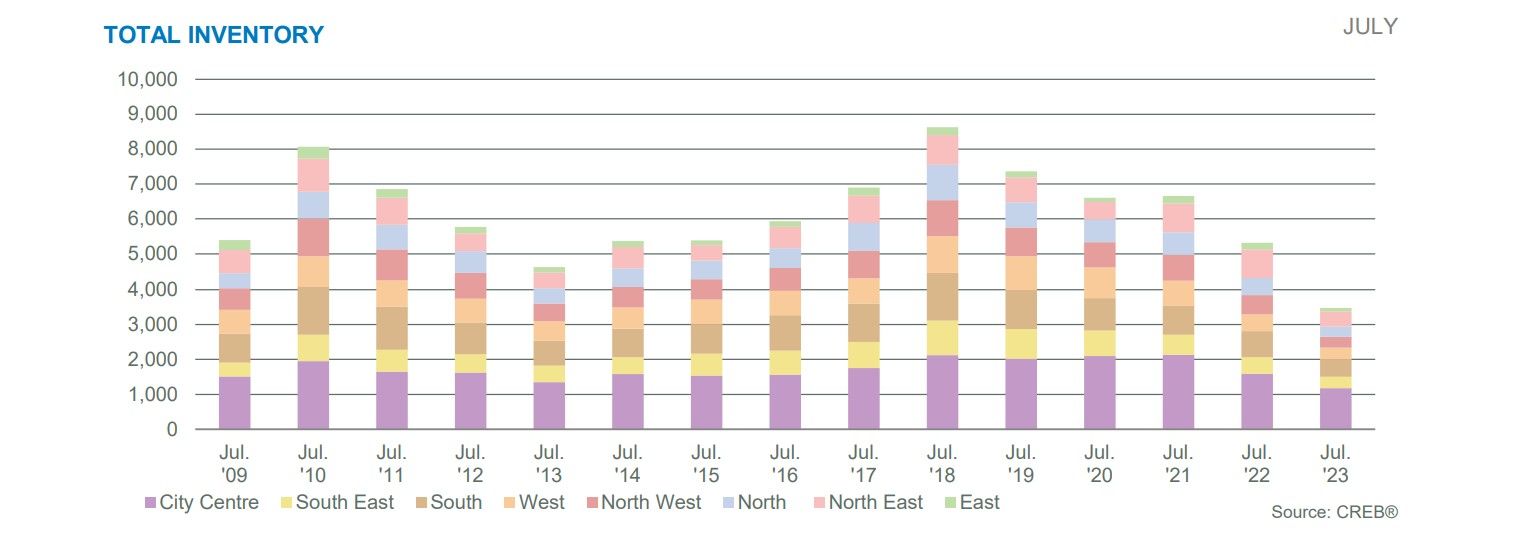

Here is the total inventory graph going back to 2009. July finished the month with 3506 homes on the market, 1800 less than last year and 3200 less or 48% less than 2 years ago.

If anyone watching this was in the market in 2018, they had almost 9000 homes to choose from. The market in Calgary was a lot different then, but you can see how much things have changed.

If we look at new housing, Alberta recorded 2368 new home starts in June 2023, a decrease of 30% from June 2022.

With resale numbers at almost record lows, residential builds are also not keeping up with the current demand for housing.

In my opinion, one of the reasons resale inventory has remained low is that unless you have to make a move, the ability for people to transition out of their current home isn’t easy. If someone is looking to move up from their existing home to something larger or more expensive, they are likely increasing the size of their mortgage, which, at the current rates, could make for much larger monthly payments. Is it worth borrowing that additional money at a higher interest rate, or do you stay where you are and re-evaluate when you get closer to your renewal date?

If you want to downsize, the affordable segments like condos and townhomes are selling very quickly and, in many cases, with multiple offers. Is this an environment you want to buy in if you don’t have to?

Similar to the expectations around high demand levels, lower inventory levels are expected to stay.

Because of the high demand coupled with the supply situation I just mentioned, our market is very tight and fast-moving. You see the impact when you look at these statistics:

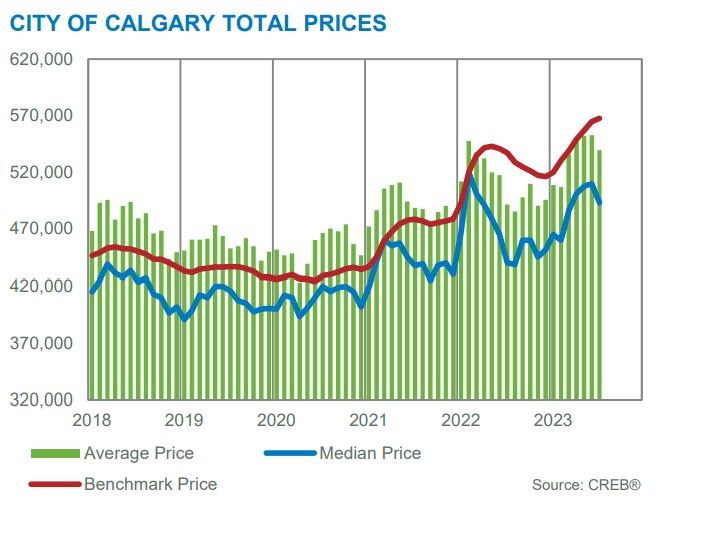

Home Values - In July, the total residential benchmark price reached $567,700, the seventh consecutive monthly gain. Prices are now over four percent higher than the previous peak in May of 2022, highlighted in this graph.

Please focus on the red line, as it is the Benchmark price.

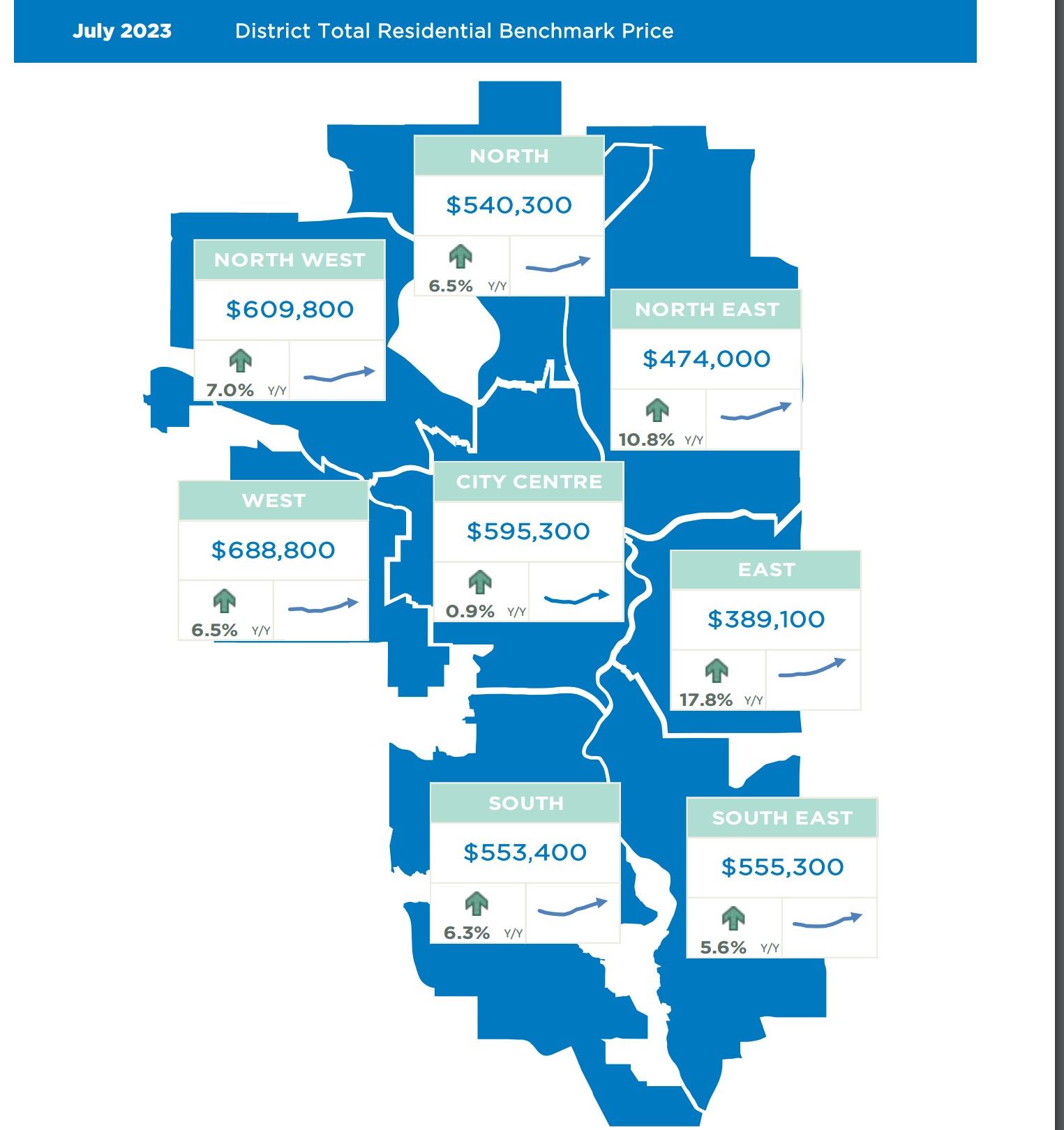

After a decline in the 2nd half of 2022, home values have fully recovered, and then some in 2023. These price increases are happening in all regions of our city, as you can see here… but are the highest in the most affordable areas, like the Northeast and east quadrants, where people are flocking to get what they want with what they can afford due to the interest rate hikes.

Days on Market

This is the average time it takes for a home to sell. Since March, the average days on the market has been under 30, and in most cases, is actually closer to the 21-day mark. This is down from the 40 ish days it took to sell during the back ½ of 2022

Months of Supply

We use this metric to measure how long it would take to sell All the existing inventory if no other homes came on the market—In July, the months of supply across all segments averaged 1.32, meaning it would take1.3 months to run out of current supply. This metric helps us determine what type of market we are in, and Calgary is firmly in a seller's market.

So that was a recap of the general market conditions, but how do things look when we break it down by the property segment,

Similar to the overall market conditions, every segment in July had positive year-over-year sales growth. The apartment segment led the way with 50% more sales vs. July 2022, with duplexes or semi-detached homes coming in next at 22%. Detached and Row Segments had a positive growth of 6 to 8%

Overall inventory levels are down across each segment, except for the apartments. In July, the apartment segment had 16% more listings added to the market, but with high demand for affordable product, that additional inventory was easily absorbed.

We saw an 8% year-over-year price growth in the Detached market, which is now up to $690K – a $5,000 increase from June and a whopping $65,000 increase from January.

Apartments are up 12% year-over-year, and benchmark prices are now over $300K for the second time ever and up $33,000 since January.

Semi-detached homes are up 7% to $616K, up $55,000 since January.

And finally, Row Homes are up 14% year over year to $407K, up $51,000 since the beginning of the year.

Okay, now we know the Calgary market has high demand and low supply, which has led to a seller's market where homes are selling quickly, and prices are increasing.

So, what can I do to navigate this if I am looking to buy or sell?

For those who are Selling…, Don’t overprice your home. It will be tempting to push the price above market value, hoping that someone is willing to pay. In most cases, your home will sit, and when someone does show some interest, you end up negotiating down to a price both (hopefully) parties can live with.

Your best chance for success is to price your home at market value, properly prepare it and position it in a way to get multiple parties interested, which in this market often leads to offers coming in above the asking price.

You often find yourself getting more money for your home this way than pushing the price up and leaving room to negotiate down.

For those planning to buy: Engage a real estate professional early!! They can help you prepare for your purchase by Understanding the market in your desired area, how quickly homes are selling, and how much they are selling for. This will help you set expectations and a strategy. With Calgary firmly in a seller's market, those with a plan are much better prepared to navigate it than those without.

Recent Posts