January 2023_Calgary and Area Market Update

In my first market update of the year I’ll be discussing what you can expect to see in Greater Calgary real estate market in 2023.

As I have mentioned before, the month of December is not an important month for real estate related data – it’s always a month where the market is in a state of slowdown & re-set.

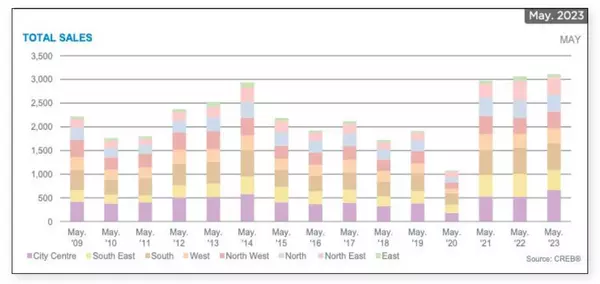

If, nonetheless, you just wanted to know what happened last month you’d see the total homes on the market dropped from about 3,100 to start the month, all the way down in the region to about 2,200 (a new record low for that time of year). Meaning there’s not a lot out there to buy.

You’d also see the number of new properties coming to market hit a yearly low –just over 1,000 homes came to market. That’s nothing new, it’s just what happens every year. And with that, you’ll also see it was our slowest sales month of the year. In December we recorded just over 1,200 sales – the same as we did in 2020, 2013 and 2007 (all ranked as the 2nd best-selling Decembers in our history, only outshone by last year’s crazy ‘unicorn’ month). So, all being said, our sales month was in good company.

But none of these December 2022 statistics matter to the 2023 outlook. What matters is how we are positioned as a region going into the new year, and our new phase of the annual real estate cycle.

January is generally a wake up, or hangover month following December. Buyers start to slowly perk up and start looking again, online searches for housing start to increase, sellers start to put their homes back on the market if they’d taken them off for the holidays, and sellers that consciously chose to wait for the new year to list will do so as the month unfolds.

So, the question is not what we should expect right now – it’s what we should be expecting this year. For this, we need to look outside the regional data and take into account the ‘macro’ world-wide stuff...

It’s no secret our region is still highly linked to the ups & downs of the world-wide oil markets. And, as a result, we benefited as the Brent Crude & WTI Prices climbed while the world was bustling these last couple of years.

We are starting the year with a price right around $80 a barrel. And, looking at predictions

for the year, we are largely expected to remain near this figure, boding well for our

largest employment sector & overall employment health.

And, speaking of that, Alberta is still sitting at an Unemployment Rate of just 5.8%, which is a fair bit lower than our long-term average of 6.55% and down nearly 2 full points from this time last year.

Now, let’s talk about the big elephant in the room driving all markets around the world – our Inflation & Consumer Price Index.

So, the silver lining of the 7 interest rate changes in 2022 is that we are starting to see inflation drop nationwide. We peaked in around June 2022 at just above 8 points, and we now sit just above 6. If things go as planned, we will be – by the end of the year – down around 3%, and then moving into the 2’s in 2024.

This brings me to another amazing article put out by The Economist this past year. What you’ll see is that Calgary ranks atop the list of best places to live in North America. This study doesn’t focus on housing prices as a major indicator – it takes into account everything from culture, environment, crime, infrastucture, health care, education, how we handled the pandemic, lifestyle options and much more. And yes, we won in 2022, but we’ve also topped this list two other times in the past decade. Those here in the Calgary region know how good we have it, but the world has also taken notice.

Calgary named world's 3rd most liveable city by Economist Intelligence Unit

So, this brings me to my final summarizing points in this update – let’s talk about our real estate market for the coming year.

We’ve now concluded that:

• Interest rates will be held to near where they are now for the balance of 2023 to ensure the

overall Canadian inflation rate comes down to the numbers the feds are hoping for.

• Oil prices are predicted to remain close to where they currently are, or just slightly below due to the world-wide recession causing lower demand.

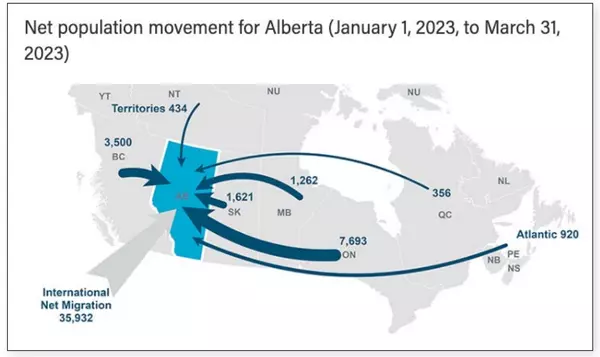

• Calgary is being seen globally as a go-to destination for lifestyle, people and profits.

• And, if you remember from the very beginning of this update, I shared our position at the end of the year from December’s housing data: the year’s lowest number of homes on the market and continued buyer demand resulting in an equalling of the 2nd best December month in our city’s history.

It should be no surprise that the forecast for this year is an increase in our property values

once again. Check out this Global News story which predicts a rise of 7% for Calgary’s housing prices.

Global News Housing Outlook 2023

So, as I said last month, for those of us in Greater Calgary real estate is by far the safest place to be right now. And if you need to, or want to, buy, do it with confidence knowing that now is the cheapest time to do so ever again in our housing market. The sky is not falling, nothing is dropping, and the demand wave continues to push in a controlled, economically and fundamentally sound way.

So, that’s it for this month. If you are in need of some help with your specific real estate situation, just email me at sglover@redlinerealestate.ca

Recent Posts